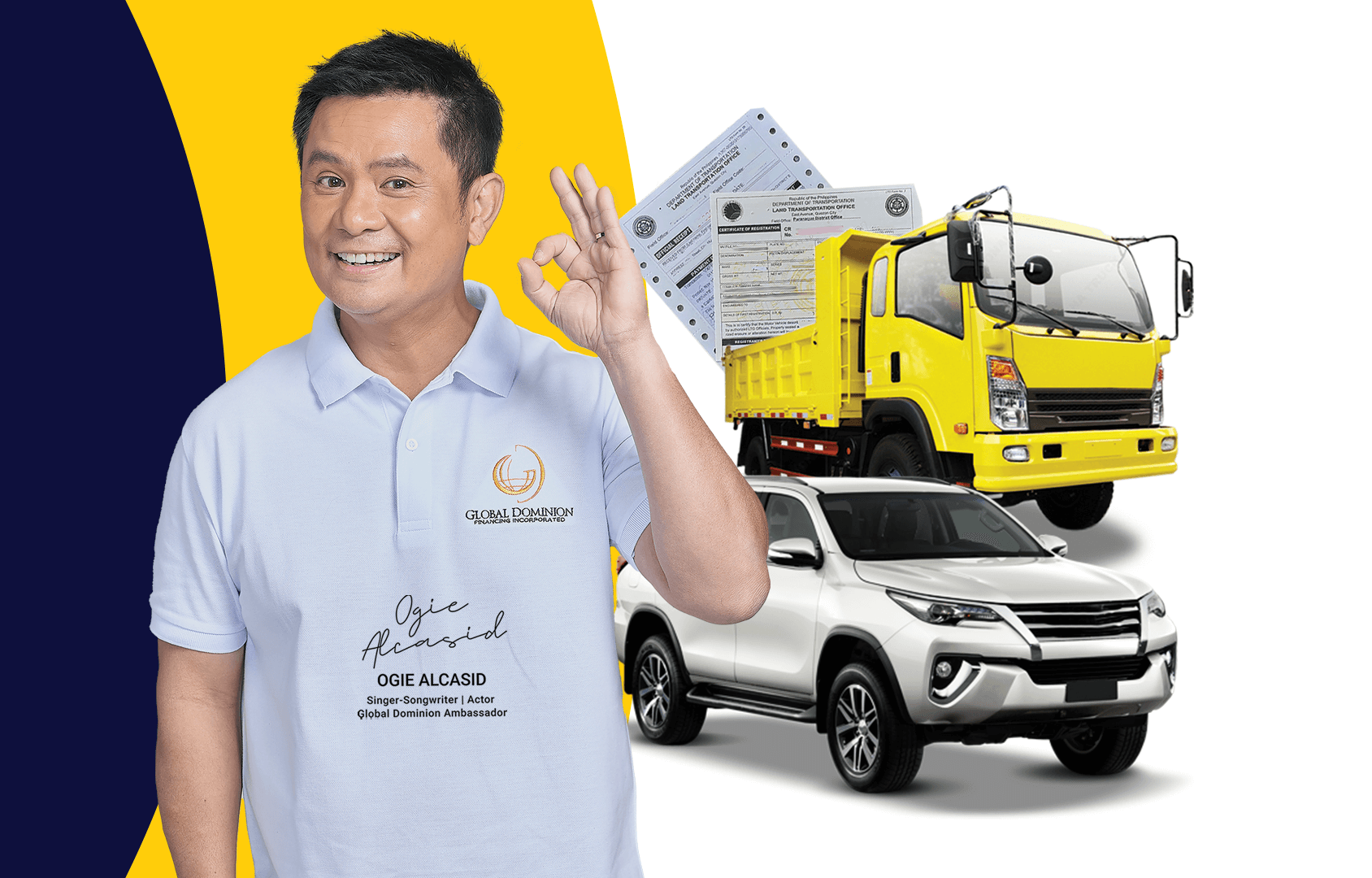

When you need quick cash but don’t want to go ORCR sangla loan the long process of bank approvals, an ORCR Sangla Loan can be one of the fastest and most practical solutions. Many Filipinos use this type of loan to meet urgent financial needs such as business capital, emergency expenses, or even personal projects. But what exactly is an ORCR Sangla Loan, and why is it considered a smart option? Let’s break it down.

What is an ORCR Sangla Loan?

An ORCR Sangla Loan is a type of secured loan where you use your vehicle’s Official Receipt (OR) and Certificate of Registration (CR) as collateral. Instead of pawning your car physically, you only submit the documents while still being able to use your vehicle. This is why many borrowers prefer it—because it offers financing without losing access to their car.

How Does It Work?

Application – Borrowers submit their vehicle’s OR/CR along with valid IDs and proof of income.

Assessment – The lender checks the vehicle’s market value to determine the loanable amount.

Approval – Once approved, the loan is released quickly, sometimes within the same day.

Loan Repayment – The borrower makes monthly payments until the loan is fully settled.

Release of Documents – After full payment, the OR/CR documents are returned to the owner.

Why It’s a Smart Option

Fast Cash Release – Unlike traditional bank loans that may take weeks, ORCR sangla loans are processed within hours to a few days.

Keep Using Your Car – Even while the loan is active, you can continue driving your vehicle.

Flexible Loan Terms – Borrowers can choose repayment plans that fit their budget.

Higher Loan Amounts – Since vehicles serve as strong collateral, lenders often provide bigger loan amounts compared to unsecured personal loans.

Less Stringent Requirements – Perfect for individuals who may not qualify for bank loans due to lack of high income or credit history.

Things to Keep in Mind

While ORCR Sangla Loans are convenient, it’s important to borrow only what you can pay back. Missing payments can lead to repossession of your vehicle. Always check the lender’s credibility, interest rates, and repayment terms before signing any agreement.

Final Thoughts

An ORCR Sangla Loan is a smart choice if you need fast financing without giving up your vehicle. It’s practical, accessible, and flexible, making it a go-to option for many Filipinos. Just make sure to deal with legitimate lending companies and manage your repayments responsibly.